Years ago, in my second job at a financial institution after college, the savings and loan I worked at was sold to Union Planters Bank. It really increased the products and level of services we could offer as we were growing from a $270 million asset based institution to a $35 billion one. The bank also did a pretty good job in getting everyone on board and excited about the change.

One day, the Realtor who had provided me with the most loans in the previous year stopped by. I proudly told him all the improvements we were going to make because we were bigger.

He replied, “Bigger does not mean anything but bigger, Phil.” That statement brought home the stark reality that bigger is not always better. My Realtor friend was worried that the personal service he received would be lost as we moved to a big bank.

In agriculture this year, we are finding out that bigger is not always better. We also saw this last year as well. While commodity prices were high, margins were great, and cash flowed abundantly. We saw farmers reach out to get more land at top dollar, or build more farm critter habitats as fast as they could put them up. After all, grain prices were going to go up forever and cattle and hogs would stay strong for a long time.

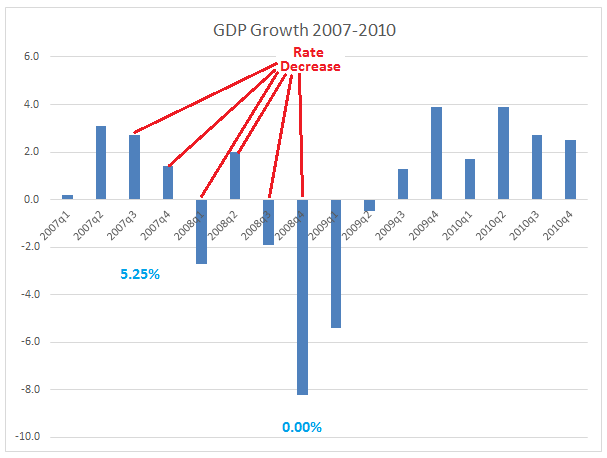

Well, those hopes have been slammed against the rocks of slow economic growth around the world. The fast growth countries of Brazil, Russia, India, China, South Africa, South Korea, Indonesia, Mexico, and Turkey, which racked up 58% of the world’s economic growth before the last few years, are now all mired in an average growth rate of 2-3%. Half of these countries are in recessions. The biggest wildcard is China, the world’s second largest economy. Official reports show growth of 6.5% but some insiders say it is closer to 2-3%.

When economic growth slows, demand for food products will slow as well. We are in a situation when this demand is anemic, we see oversupply of commodities compared to demand, and producers are suffering. Oil prices, which can impact up to 80% of other agricultural commodity prices, have been mired in the $40 range. That keeps some of the input costs low but also impacts the product price in the end. A roaring commodity market will hide a multitude of sins when things are going very well, but all can come crashing down when the economy slows.

When things are really great, it is also a time when there is less focus on the performance of the producer from both the producer’s side and also the lender’s. Since the situation has reversed now, it takes a paradigm shift on both parts in order to survive. The problem with some producers, is they expect the lender to bear all the risk with carrying over all the operating debt.

As with any industry with any type of economy, we have great and poor performers. When times are great, even the poor guys can look OK. The problem today is that the poor performers will not likely survive into another year or two in the current environment.

With our current situation today, it is important to be able to identify those behaviors that may be a part of the poor performer and those of the top producer. Poor performers may not have adequate supervision of their business. This can come from a lack of ability or willingness to see things as they are as a producer; it may also mean the unwillingness to listen to trusted advisors. Top producers will zero in on costs. The best ones will find ways to cut in the current environment to increase the profit margin. Top producers are also upgrading their financial records, not only for the lender, but also as a tool to help them make better decisions. Top produces are also meeting regularly with lenders and other advisors to hear what their ideas are and see their views.

Poor producers are in a trap of a shell game of robbing Peter to pay Paul. We see this as they attempt to jump from one lender to another to satisfy gaps in operating cash flow. You may actually also see them trying to double down on an already losing crop. It is like they are trying to make up for the loss with volumes of more losses! Top producers will make hard decisions to change course at times which means exiting some business lines or scaling back when the time calls for it. They may also look at diversifying into other lines of business.

Look for bubbles in the commodities market and how that may impact the weak producer. The weak one fails to build extra cash reserves when the bubble is inflating. This is one reason we see problems with grains in the past two years. We are also seeing some issues in the cattle and swine producers. One commodity bubble that may still be inflating today is poultry.

Our problems today in the ag economy is somewhat muted as we have low interest rates and relatively strong equity positions overall. Now is the time for the producer to restructure his balance sheet in order to produce some extra cash flow, lower debt, and increase margins. For many, if we see another year or two of challenge, the time will be too late.

I encourage you to reach out to us at Pactola. We have some longer term secondary marketed fixed rate farm financing vehicles that can provide a better structure to the debt stack on your producers.