According to the US Department of Commerce’s Bureau of Economic Analysis, the last quarter of 2013 represented the 11th straight quarter-to-quarter growth in US Gross Domestic Product (GDP). The latest increase for 4th quarter 2013 was originally reported at 2.6%. Yet, when we look at this “recovery”, it seems to be marked with a large number of unemployed, a record low labor participation rate, and small business failures. Another characteristic I will focus on here is that the recovery still remains a secret to lenders.

Fortune reported early this year that JPMorgan achieved strong earnings in 2013 with profits of $18 billion. One item in Morgan’s year ending 2013 financials stands out; the bank’s loan-to-deposit ratio hit a new low. In 2013, the bank lent out an average of 57% of its deposits; down from 61% a year earlier. This trend is not only true of Morgan, it is common across the entire economy.

So, what if the loan to deposit ratio is low and falling during an economic expansion? While this may be expected during a recession for banks to reduce lending and keep more reserves on hand, it is not as common this late in an expansion. It also indicates the availability of credit for businesses to expand is limited, which can hinder future economic growth as firms need capital to expand. It may also mean that demand for loans is lower as borrowers are less likely to borrow in the future because of uncertainty, or their belief that the reward from the borrowing is less than the risk associated with the loan. It may also mean that firms are stockpiling their own cash and not borrowing. Forbes indicated on its website that American companies are holding onto over $5 trillion dollars of cash. We also have reports of the wealthy hoarding cash as well.

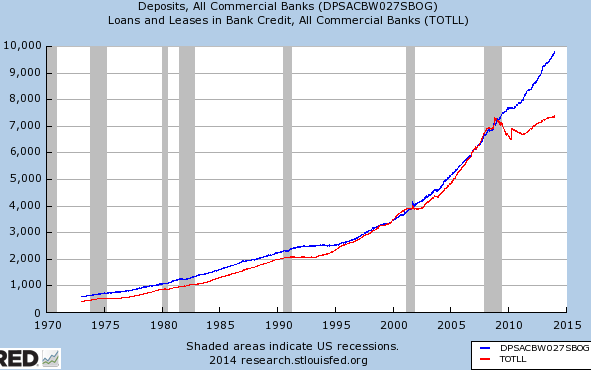

The following chart is from the Federal Reserve Bank’s FRED data. Note that the gap between loans to deposits is at $2.4 trillion and growing. This divergence seems to be unique to the post financial crisis environment.

One wonders just how strong the US economy would be if the loan to deposit ratio were closer to norms? Demand for credit is weak due to economic uncertainty, large amounts of cash on company’s balance sheets, jittery labor markets, poor wage growth expectations, general unease of taking on debt, and governmental uncertainty.

On the supply side, lenders are less willing to lend money due to tighter credit standards. Another huge factor is the regulatory uncertainty; a good example is the proposed new capital rules for credit unions. The excess of supply of funds to demand for loans has also pushed rates down to levels where some loans are unprofitable, given the amount of risk in the transaction. This pricing challenge is what we currently deal with in the lending world.

Another factor on the supply side is the ability of banks to keep large reserve positions with the Fed. These reserves are placed at the Fed instead of lending out to borrowers. The Fed is paying 25 bps, and these are funded with deposits that pay near 0%. This creates riskless profits with no regulatory capital requirements. The excess reserves in the banking system is now about $2.4 trillion, the same amount as the gap between a traditional loan to deposit ratio and what we see today. The following chart shows the loan to deposit ratio which is at a 30 year low. Note the tick up in 2010 is due to an accounting adjustment and not a true trend.

One day, when we look back at this time, we will wonder what sort of economic growth we might have witnessed if a normal loan to deposit ratio were in place. This truly is a “what-if” economy that continues to keep us dreaming about what could have been if we would see a normal loan to deposit ratio.