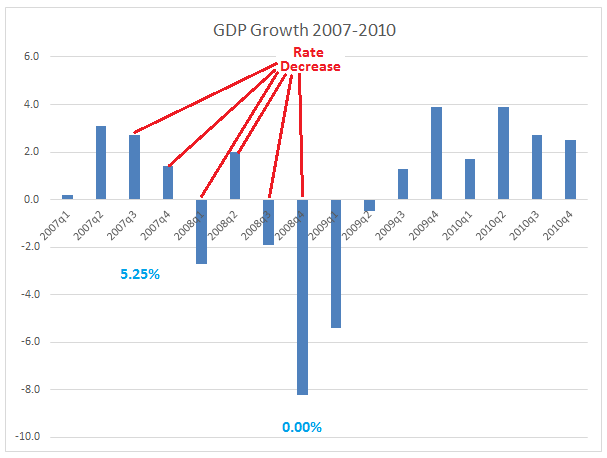

There is a lot of discussion about the Federal Reserve raising the Fed funds rate. This is typically done to counter inflation or prevent reckless economic expansion. As we all know, there isn’t much pressure from inflation currently, with the last reading coming in at 1.1%. Then it begs the question, is our economic expansion really that strong that the Fed needs to start applying the brakes? I constructed the following graph below to show what quarterly GDP growth looked like leading up to the Great Recession, and as you can see, it was a period when the Fed was starting to strongly apply the brakes with higher interest rates. The overnight rate peaked at 5.25%, and GDP was consistently above 2%, and over 3% in half the quarters presented.

Now compare that to our current economic picture, for which I constructed another graph you can observe below. In less than half of the quarters in the last 4 years, have we seen GDP at or above 2%. And take note, before the Great Recession, the Fed was raising rates and the economy was still exceeding 2% regularly. As you can see below, the Fed only raised rates at the end of 2015 for the first time since 2006.

Still, while the economy doesn’t seem as strong as before, it isn’t bad. There are 7 quarters that jump above 2% growth, 4 that were above 3% growth, and even a couple that exceeded 4% growth. The economy is rolling, so how fast does it need to roll before the brakes of higher rates should be applied? That is subject to great debate at the Fed, and some feel now is the time to start applying those brakes. Especially considering, maybe years leading up to the Great Recession were too hot with growth, and maybe the Fed wasn’t applying the brakes enough. In this case, it might make sense to start raising rates now to keep momentum from flying out of control.

I believe there might be a different reason the Fed wants to raise rates, and that is they fear they will not be able to stimulate the economy by lowering rates if we happen upon another recession. As you can see in the following graph, the Fed saw the economy was stopping and about to move backwards, so they released the brakes as fast as they could. They decreased interest rates from 5.25% to 0.00% in a matter of 18 months! While we cannot say the Fed is definitively responsible for what came next, we can see from the graph we entered a deep recession, but it was relatively short-lived given how deep it was. The low interest rate environment may have helped keep credit affordable so businesses could quickly recuperate.

So the Fed is faced with a dilemma. They aren’t sure when it is the right time to raise the rates, but they know the economy isn’t as hot as it was before the recession. And, with rates so low they are lying on the floor, they won’t be able to really decrease rates to stimulate the economy back to life if another recession hits. Yellen has repeatedly indicated that the Fed will continue to watch the news and analyze current data to determine if the economy is picking up speed, so they have a reason to raise rates. And with rates on the floor, they very much want to raise rates to give them a policy tool again.

I would argue you don’t have to look hard anymore to find news for Yellen and the Fed to make their case that now is a good time to act. This week alone, I’ve seen articles on CNBC identify the strong expansion of home flipping in recent quarters, and Wells Fargo’s announcement of allowing smaller down payments on homes. To put the icing on the cake, Jamie Dimon at JP Morgan Chase brought auto loans to everyone’s attention. Borrowing for cars has reached record highs, with record high payments, and record high terms. I can definitely hear the brakes screeching at the Fed. I fully expect we are in a rising rate environment.

http://www.cnbc.com/2016/06/02/jamie-dimon-just-sounded-the-alarm-on-auto-loans.html

http://www.cnbc.com/2016/05/26/wells-fargo-launches-3-down-payment-mortgage.html

http://www.cnbc.com/2016/06/02/house-flipping-heats-up-creating-home-price-pressure-cooker.html

http://www.usinflationcalculator.com/inflation/current-inflation-rates/