One of the most common causes of borrowing for a business is an operating line of credit. Here, a company or farm will borrow money to continue business while time passes in the cash conversion cycle from the time a product is created, through the sales cycle, and to the time that cash is received from the company. Often, this cycle can have times when the cycle “sticks”. Perhaps this may come from waiting for the crop to mature or for the collection department to get payment on an outstanding invoice.

In a perfect world, these operating lines are paid down to zero at some time during the cycle. Maybe this is after the crop is sold or during a slow time of sales but high time of cash collection. Many times, this is not paid completely to zero but is paid down to a certain level. Operating a business creates a level of operating cash that is just needed for the day to day activities. Expenses occur each day and do not always match up with the timing of cash received.

If you were to graph your client’s operating line usage, you would be able to tell where is an average minimum usage. This level can be considered as permanent working capital. The business needs this money to operating no matter what happens. It may be desirous of the lender to eventually have the borrower wean out of needing the permanent working capital over time. Perhaps this is done with an amortizing note.

The fluctuating usage of credit over the permanent working capital is the temporary working capital. This will go up and down over time and ideally it would get paid down to zero. But what happens if it does not? This may be an event that happens in the real world.

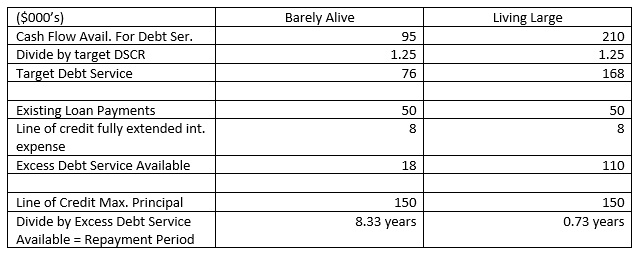

One analysis that is done is to assume the unpaid line of credit is fully advanced and termed out. The debt service on the line is run through the normal debt service calculation as shown below in the companies below.

In this case, Barely Alive will make their debt payments, but not be able to meet a standard 1.25 debt service coverage ratio (DSCR). Now there is a temptation for the lender to extend the amortization on the line of credit to make the ratio better, but that is not always the wisest move. Also, some of you will note the 6% interest expense and think that is too high. It is time to realize that interest rates are marching upward. Prime interest rate, which is defined as the base interest rate for short term lending to the strongest bank customers, is currently at 5%.

Another method to look at the line is to figure how long of a repayment period would be needed to retire the debt completely and stay within proper DSCR thresholds. Consider our example:

In this example, it will take Barely Alive 8.33 years to retire the principal on the line of credit, while Living Large will have this completed before a year cycle is over. This calculation can be looked at over several cycles to get an average performance.

The answer here is not to just extend an amortized line to keep DSCR acceptable for Barely Alive. It may be very possible that in the next 8 years, they will need another operating line, or several to continue. I would say that it may be time to become defensive in lending and find ways to take additional collateral for the line or get the owners to put in more equity into the company to retire the outstanding line. In some cases, you need to just ask Barely Alive to find another lender while they are still alive. Sometimes that lender in your community who is very hungry to build new business, may be your best friend as you refer your future problem to him.

Doing a rough calculation on the repayment period contrasted with the current or average performance of a company may help provide some prospective when stronger covenants, more collateral, or a more disciplined approach should be applied.