In the last two regional institutions I had the privilege of working for, loans that failed were inspected closely. Now if the credit failed in the first year or so of the loan, much scrutiny, as is warranted, was placed upon the credit analyst and field lender for not picking up on the inherent credit weakness during underwriting. After that time, more emphasis came on the ongoing management of the credit as opposed to the original underwriting. Years ago, a competitor banker in my hometown told me, “You can’t always underwrite and identify every future problem.”

Which is completely true. No credit professional is a perfect prophet, though many may call us to be so. The presence of problem loans, if these problems have arisen from unforeseen events or things occurring after the first year or so of the credit, do not point to a weakness in underwriting. These problems are an opportunity to identify and best manage the relationship. If not completed properly, this points to losses and possibly, an unhealthy credit management function.

In the last bank I worked for, we were required to do the “spilt milk” report when a credit failed or was in terminal health. The adage was to not “cry over spilt milk”, but to use this as a tool to learn how to better analyze the risk inherent in the credit. We recognized there are several things which could impair a business, which underwriters may never see.

Divorce can cause a huge disruption to a small, closely held business, especially if the two getting divorced are the active owners. Anyone seasoned in the commercial area has a few stories with this disrupter. The effects can cause immense hurt financially, managerially, as well as personally. I once had a very successful transportation company which failed after one of the owners had an affair. Though it may be rare when the lender sees possible problems on the home front, when they do arise, notice should be taken.

Drugs is another disrupter of a business. It was also involved in my example above. This could be either prescription or illegal drug abuse. One may also include any type of addictive behavior. Addictions often push a person to pursue that appetite instead of fulfilling responsibilities with their business. Note that an addictive behavior that causes a business to fail may not be from your business owner, but also someone in his family. I once knew of a retail store which closed due to employee embezzlement. The owner became absent when dealing with a substance abuse problem with his son, and the untrustworthy employees took advantage of not being watched.

Disability is the third disruptor of credit. I watched a small family manufacturer sell at a fraction of its value. The owner was absent and had a key employee who was the brains behind the business. That leader suffered a stroke. Unfortunately, the employee tended to micro manage every function of the business and did not train others in how to successfully run the operation. When he was unable to function completely, no one else knew how to keep the business open. The company liquidated its assets and closed.

Disagreement among the owners or management team is our next disruptor. A hotel operated very well in the good times, but failed to break even when visits dropped off because of the local economy. At first, the owners pulled together and worked on a plan to move forward. Soon, individual owners began scrutinizing the past track record and squabbles broke out in the group as more checks were written each month from a collective group which intended to reap profits from the business as mailbox money. Discussions among the owners now went through attorneys, and the lender sat on the sidelines watching this train wreck happen. Differences of opinions will come when you have more than one person involved in a business. Those differences can strengthen the company. But if no one overall plan is found for all to get behind and move forward, and especially if communication has disintegrated among the owners, watch out!

Death of an owner, key player, or manager can kill a business. This is especially true in companies where key leaders who do not raise up others to operate the business. Maybe this is due to a lack of time, leadership ability, or fear that someone will take over their importance. Some of this risk can be overcome with key man life insurance. In the end, such insurance may help retire debt and help the business continue for a while, but without additional leadership, the business will close.

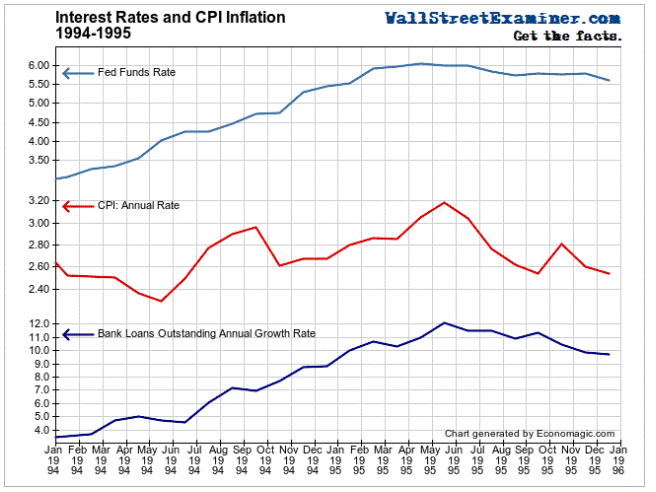

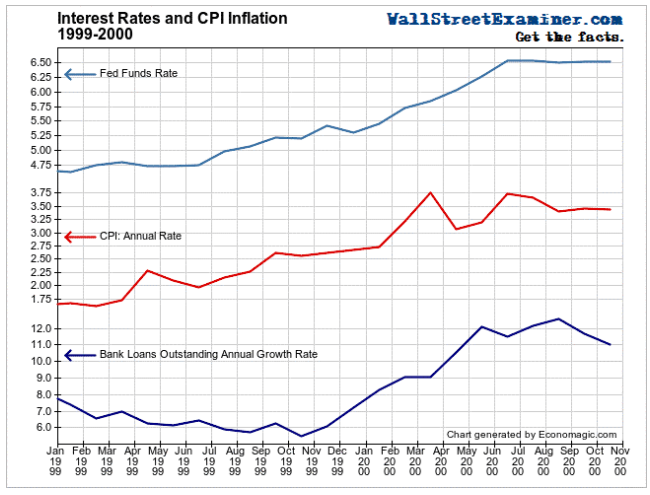

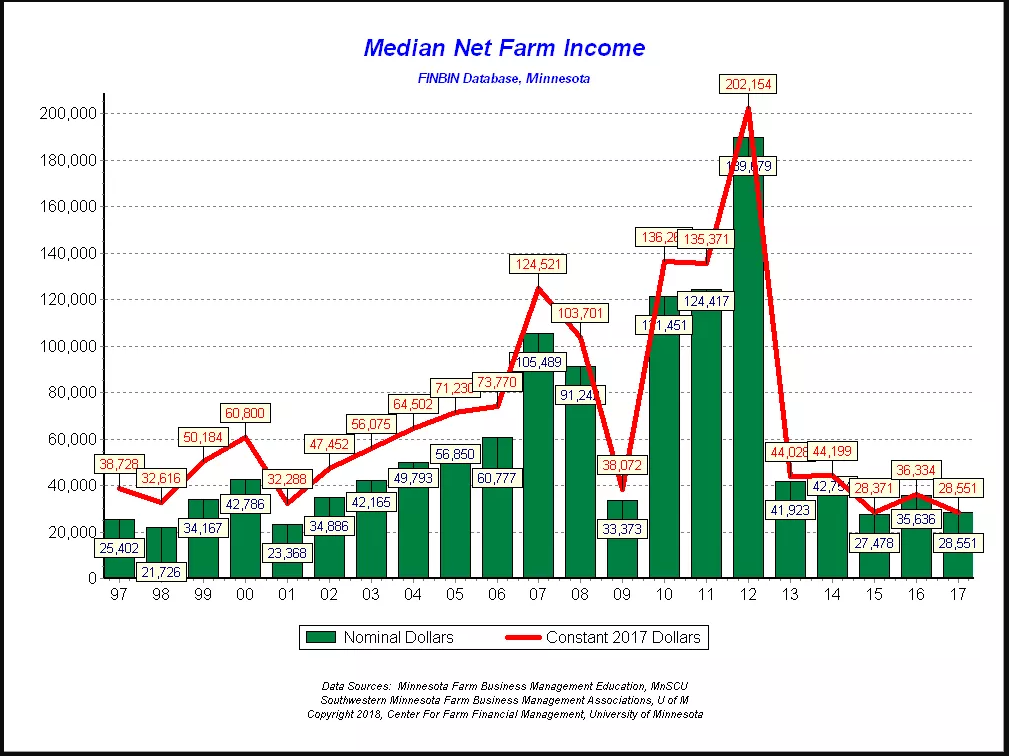

Disaster is the final disrupter of credit that I will address. This is a large category and items like hurricanes, tornadoes, blizzards, drought, and other “acts of God” as often put in insurance policies. Other items in this category may be a commodity price crash, like agriculture prices in the past three years. Some factors of the interest rate hike in the late 1970s may be put here. These are unforeseen “black swan” events which can sink a business and pull down your loan. Asking if your client has a contingency plan and what events are covered in those plans is helpful.

While it is true that loan failures many times are not seen at the time of underwriting and may occur years later, it is still important to carefully analyze every credit failure as a teachable moment to help manage risk better in the future. The best lenders are not those who never make a bad loan; the best lenders are those who know what to do when a loan weakens.

Quick Bites: As I write early this rainy morning, it is Father’s Day. I pause to honor my dad, who taught me the value of persistence, hard work, virtue, faith, and honor. I can never thank him enough.